[ad_1]

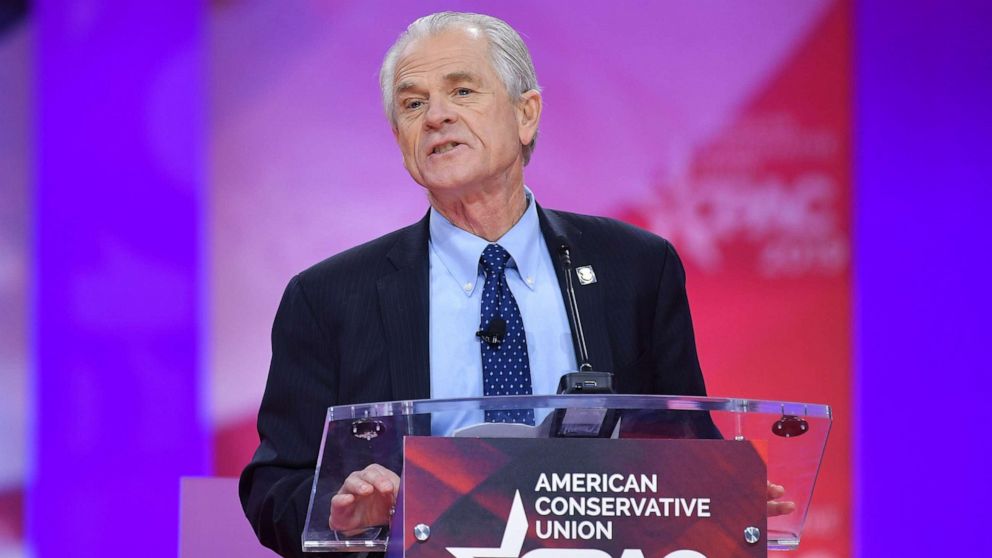

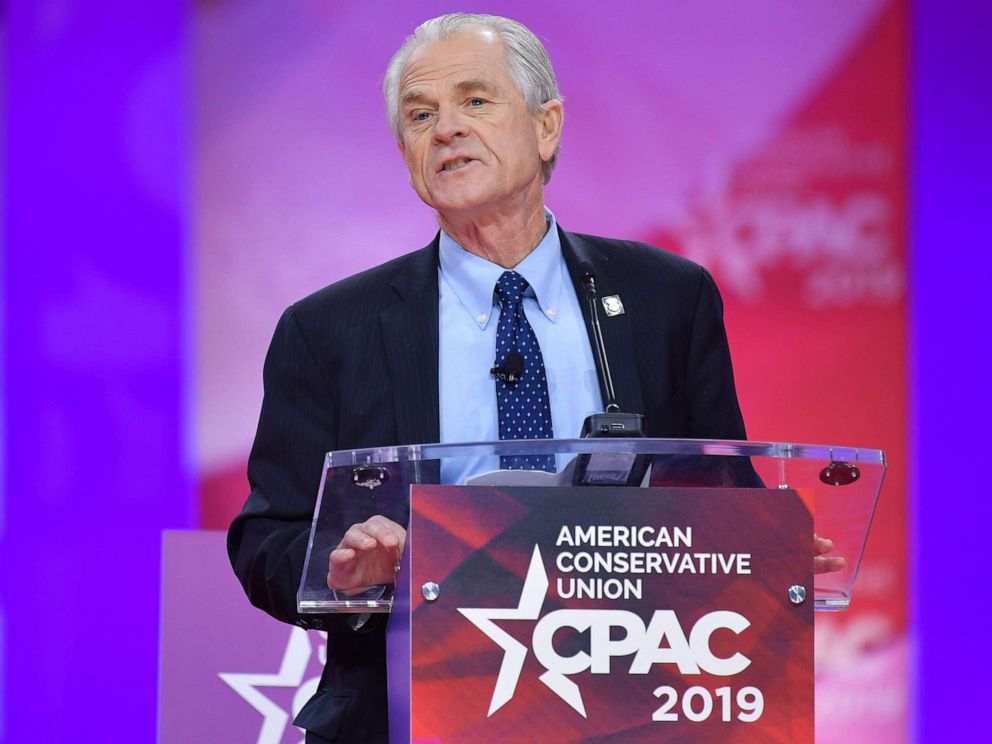

White House trade adviser Peter Navarro declared the U.S. economy will be strong through 2020, and the Federal Reserve will be lowering interest rates again, “significantly,” going into the holiday season, in an interview with “This Week” on Sunday.

Interested in Trump Administration?

Add Trump Administration as an interest to stay up to date on the latest Trump Administration news, video, and analysis from ABC News.

Navarro also pushed back against reports of an inverted yield curve, in which the yield on long-term bonds dips below the yield on short-term bonds, and warnings it could be a sign of a recession to come.

“We did not have a yield curve inversion right now, by technical standpoints. You have to have a significant spread between short and long rates,” Navarro said.

He went on to say the curve is actually flat.

The Dow dropped 800 points on Wednesday, the worst day for the stock market this year, after concerning indicators from Germany and China and signs of an inverted yield curve sparked fears of a recession.

The S&P 500 and the Nasdaq also fell on Wednesday, and the markets closed flat on Thursday, retaining most of the losses.

Mandel Ngan/AFP/Getty Images

Mandel Ngan/AFP/Getty Images

Navarro also responded to recent Wall Street Journal editorials dubbing recent market turmoil “the Navarro recession.”

“When the ‘Main Street Journal’ starts attacking this administration, that is when we worry,” he said. “It’s called The Wall Street Journal for a reason. Okay? It represents Wall Street.”

He also touched on the Trump administration’s decision to delay a 10% tariff on $300 billion worth of Chinese imports until Dec. 15.

“One of the things the president does beautifully is engage with the business community, labor leaders and everybody in between,” he said, adding that business leaders urged the president to delay the tariffs.

Trump, Navarro and other administration figures have insisted China would be hurt the most by the tariffs. “To date, China has borne virtually the entire burden of the tariffs, and frankly we’re surprised at how aggressively they’ve been willing to bear that burden,” Navarro said Friday on CNN.

However, many economists have said American consumers are the ones who would pay instead of China, with an additional 10% cost added to the price of many items when tariffs go into effect.

When asked by Raddatz if he was optimistic about the administration’s ability to reach a deal with China on trade, Navarro responded, “I’m optimistic that the president will do the right thing for America and that we have some significant structural issues with China that we need to address.”

[ad_2]

Source link