[ad_1]

“We are doing tremendously well,” the President told reporters on a tarmac in New Jersey before boarding Air Force One to return to Washington. “Consumers are rich, tax cut loaded up with money. I saw Walmart numbers through the roof, better than any poll,” he said.

Trump conceded on Sunday that economies across the world are “not doing well like we are doing, the rest of the world, if you look at Germany, if you look at European Union, frankly, look at the UK, look at a lot of the countries, they are not doing well.” Trump added that “most economists actually say we are not going to have a recession.”

Trump said the US has options on how to handle a recession, but that it would happen only if he had no choice but to take on China.

“If I wanted to make a bad deal and settle on China, the market would go up. But it wouldn’t be the right thing to do,” he explained. “I’m just not ready to make a deal, China would like to make a deal, I’m not ready.”

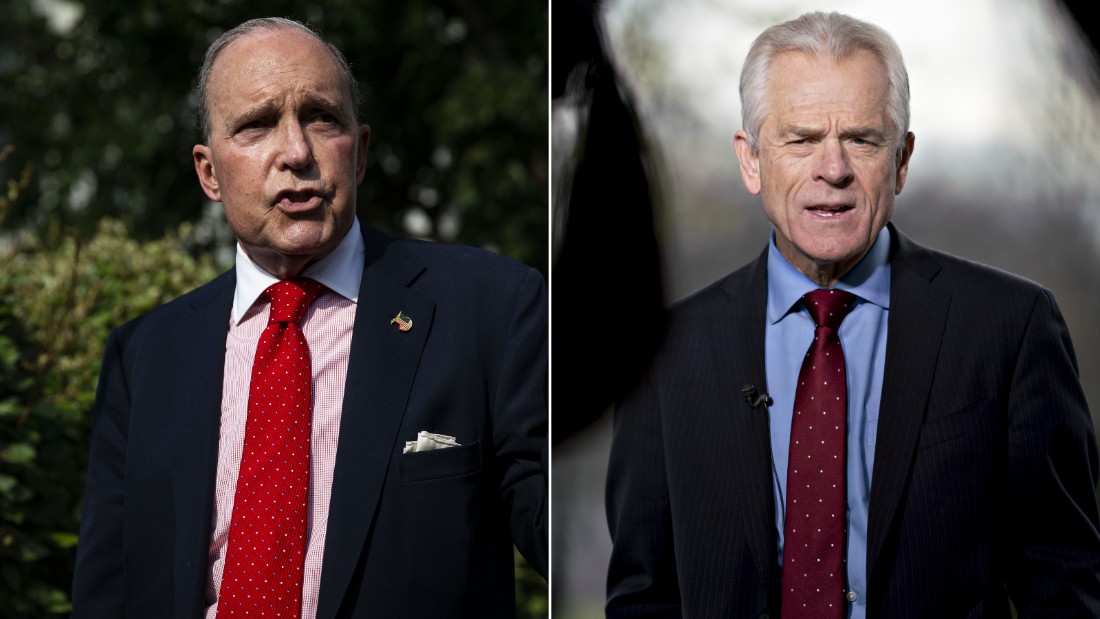

Trump economic advisers say US not cusp of recession

“No, I don’t see a recession. And let me add just one theme … Just one theme. We’re doing pretty darn well, in my judgment. Let’s not be afraid of optimism,” Larry Kudlow, the White House’s chief economic adviser, told NBC’s Chuck Todd on “Meet The Press.” In a separate appearance on “Fox News Sunday,” Kudlow told host Dana Perino that he didn’t see a recession “at all.”

Earlier Sunday, the two officials sought to draw positive attention to the US economy, with Navarro telling Tapper, “What we see now is foreign capital coming to the best game on the globe, which is the Trump economy. It’s going into our stock market.”

Kudlow also looked to refocus attention on economic gains under Trump, saying on NBC, “We had some blockbuster retail sales, consumer numbers towards the back end of last week. Really blockbuster numbers.”

He said despite the worries about a volatile stock market, “most economists on Wall Street towards the end of the week had been marking up their forecasts for the third and fourth quarter. That echoes our view.”

CNN’s Jason Hoffman, Kate Sullivan and Paul R. La Monica contributed to this report.

[ad_2]

Source link