[ad_1]

America’s affordable-housing crisis shows no signs of going away anytime soon, and it’s having the starkest effects on people with the lowest incomes, according to a new report.

There is a staggering shortfall of 7 million available and affordable rental homes for extremely low-income renters, according to “The Gap,” a report published by the National Low Income Housing Coalition on Thursday. To put it another way, for every 100 of the lowest-earning renter households in the country — those at or below the federal poverty line or 30 percent or less of the median income in their area — there are only 37 available and affordable rental units.

The crisis is urgent, says the report, which calls for a large injection of funds into federal housing programs designed to help the poorest renters. Its publication coincides with the release of President Donald Trump’s 2020 budget request, which proposes sweeping cuts to affordable housing programs and would undermine the already inadequate support systems in place for low-income renters.

“The report shows us this year, as it has for many years, that the housing crisis remains at historic heights,” said Diane Yentel, the president and CEO of the NLIHC, “that it’s having the most harm on those on the lowest income — seniors, people with disabilities, working parents and others.”

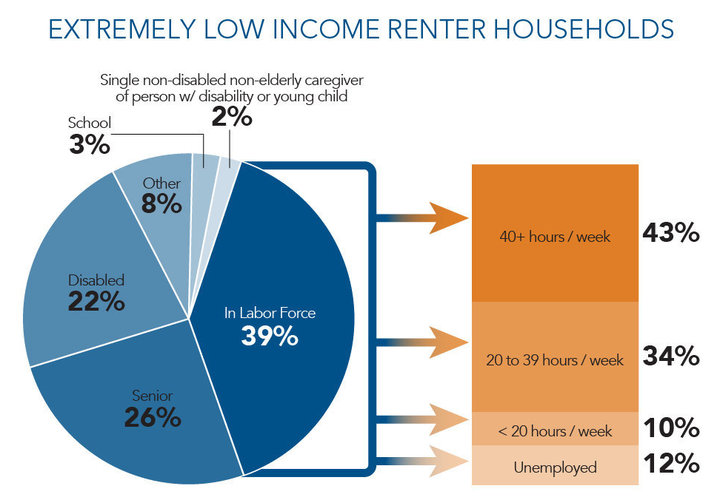

Of the 11 million renters in the U.S. defined as extremely low income, nearly half are elderly or disabled, 39 percent are working, and 3 percent are in school. The lowest-income renters are disproportionately people of color: 38 percent of Native American households, 35 percent of black households and 28 percent of Hispanic households have extremely low incomes.

The dire lack of affordable rental homes means people are forced into homes they cannot afford. More than 70 percent (7.8 million) of the lowest-income renters are classified as severely cost-burdened, meaning they spend over half their income on rent and utilities.

With such little income to begin with, said Yentel, having to pay such a huge proportion on rent leaves people in incredibly perilous situations. “You have very little left over for all of life’s other necessities, and you are one unexpected financial cost — a sick child, a broken-down car, a missed day at work — away from not being able to pay the rent and facing potential eviction and, in the worst cases, homelessness,” she said.

This forces families to make huge sacrifices. They have far less to spend on transportation, food and health care — $354 per month less than a poor family that is not cost burdened, according to one study cited in the report — and are more likely to cut back on prescribed medication or other health care. A study last year found that families that fall behind on their rent have lower health outcomes. Housing instability affects children’s education prospects too, as forced moves and the threat of eviction can be big obstacles to learning.

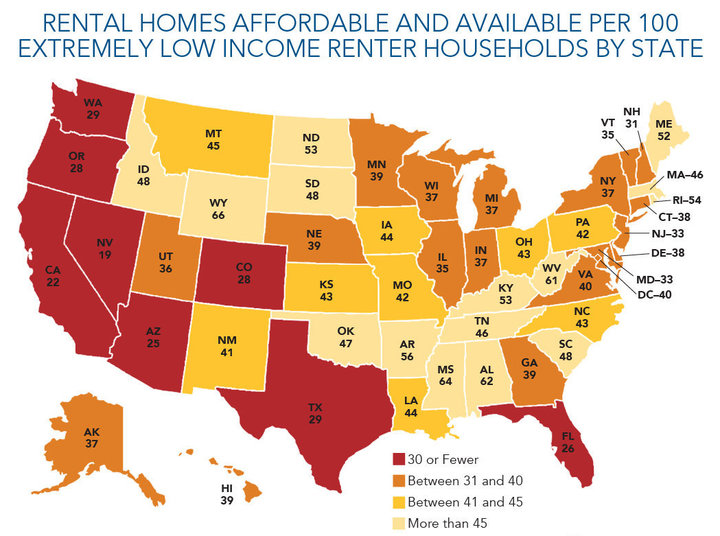

The affordable-housing shortage for the poorest renters tracks across America.

“There aren’t any communities where the rental housing market works to make housing affordable for renters with extremely low incomes,” said Josh Leopold, a senior researcher on affordable housing at the Urban Institute.

Wyoming has the largest supply, according to the report, but it has only 66 rental homes affordable and available for every 100 of the state’s poorest renters. Nevada has the worst figures, with only 19 per 100.

Nevada’s housing crisis is so severe for a number of reasons, said Chad Williams, the executive director of the Southern Nevada Regional Housing Authority. The state has too few homes “because builders stopped building housing units at a reasonable pace during and after the housing crisis,” he said. It has also seen an influx of people from California seeking lower rents. And all the while, salaries have failed to keep pace with housing costs.

It’s a story that is echoed in different ways across the country, where the housing crunch is now decades long, exacerbated by the foreclosure crisis starting in 2008, which spat out former homeowners into a rental market already under a huge amount of pressure. We would have to go back to the 1970s, according to Yentel, to find a time when there was a surplus of affordable housing for extremely low-income renters. “And the primary difference between then and now,” she said, “is declining federal investments in programs that housed the lowest-income people.”

We have the solutions. … The only thing we actually lack is the political will to fund those solutions.

Diane Yentel, president and CEO, National Low Income Housing Coalition

Reliance on the private housing market to build more homes won’t cut it, says the report. The costs of developing and maintaining new homes are simply not covered by the rents that the lowest-income renters can afford. In 2017 the average monthly rent for a new apartment was $1,550, more than twice what the lowest income renters could afford.

Older low-cost housing, meanwhile, is disappearing from the market.

“In some areas, particularly in Rust Belt cities … a lot of the public housing and non-subsidized affordable housing stock has been demolished,” said the Urban Institute’s Leopold. Other rentals are seeing changes in use or upgrades that allow owners to charge higher rents.

The solution, according to the report, is a huge and sustained investment in federal affordable housing programs targeting the lowest-income renters. This would include programs that build and maintain housing, such as the Housing Trust Fund; programs that provide rental assistance, like the Housing Choice Voucher Program; programs to rehabilitate crumbling public housing; and schemes to provide cash assistance to families facing eviction or homelessness because of unexpected financial expenses.

Solving the affordable housing crisis is simple, said Yentel, even if it won’t be easy to execute. “We have the research. We have the solutions. … The only thing we actually lack is the political will to fund those solutions at the scale necessary,” she said.

“We need leadership,” Williams said, “from the federal government, in particular from HUD [the Department of Housing and Urban Development]. … We should have a leader that is a proactive champion of affordable housing.”

But this political will is extremely unlikely to arrive under the current administration. The White House’s 2020 budget request, released on Monday, included deep cuts for affordable housing programs. HUD would see its budget cut by 16.4 percent.

While that budget has zero chance of getting through Congress, it should not be ignored, said Yentel. “The budget proposal is the best opportunity an administration has to lay out its values and its priorities, and clearly this administration does not prioritize affordable housing,” she said.

HUD Secretary Ben Carson acknowledges the problem of affordable housing. “Today’s rapid urban growth is causing urban growing pains — especially in the housing market,” he said in a speech on March 6. A former neurosurgeon, he added, “Any doctor would agree: it is not healthy for this kind of pain to persist.” That speech went on to celebrate public-private partnerships to improve public housing and tax incentives for companies to invest in low-income neighborhoods.

But Carson seems highly unlikely to back big federal investments in low-income housing. In a 2017 New York Times interview, he said he did not want to give low-income renters “a comfortable setting that would make somebody want to say: ‘I’ll just stay here. They will take care of me.’” And in 2018 he called for increasing the rents for the poorest households.

The Trump administration’s priorities aside, housing is becoming a hot-button issue politically as the housing crisis deepens. States and cities are introducing a raft of measures to tackle affordable housing.

In California, newly elected Gov. Gavin Newsom has announced $1.75 billion of funding for home building, including for low-income renters, and threatened to withhold funds for roads from cities that don’t build enough housing.

Oregon has just passed the first statewide rent control regulations, which limit rent increases to 7 percent per year. And Minneapolis will rezone the city to allow multifamily homes in a bid to make housing more affordable and tackle its history of racial discrimination in housing.

Democratic 2020 presidential candidates are offering up their visions of a more affordable housing system — from Sen. Elizabeth Warren (D-Mass.), who has called for $450 billion to be invested over a decade to create and preserve affordable housing, including building over 3 million new apartments, to Sens. Corey Booker (D-N.J.) and Kamala Harris (D-Calif.), who said they want to provide more rental assistance through major renters’ tax credit bills.

While Yentel said none of these proposals on their own would solve the housing crisis, she praised them as “bold and ambitious and on a scale the likes of which we haven’t seen in generations. [Senators and presidential candidates] are putting forward proposals that are not tinkering around the edges. They are not shying away from the fact that solving this crisis will require major federal investments in the solutions themselves. So I do think that the tides are turning.”

For more content and to be part of the “This New World” community, follow our Facebook page.

HuffPost’s “This New World” series is funded by Partners for a New Economy and the Kendeda Fund. All content is editorially independent, with no influence or input from the foundations. If you have an idea or tip for the editorial series, send an email to [email protected]

[ad_2]

Source link