[ad_1]

By Lisa Snowden-McCray, Special to the AFRO

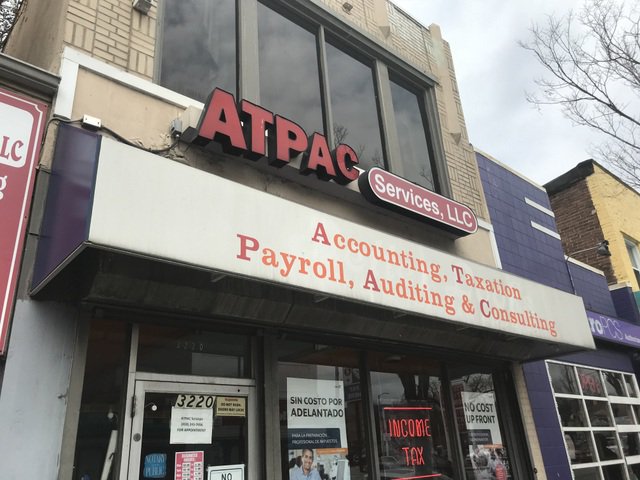

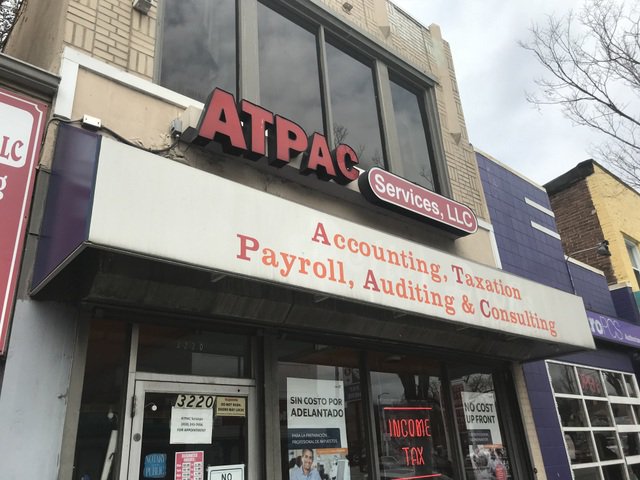

Anthony Moon, CEO and president of Baltimore-based ATPAC accounting and tax services (also, full disclosure, the guy who does my taxes), says that people should be careful about who they pay to file their own taxes, because not everyone is legitimate.

“People need to be aware of persons charging fees based on things like the number of dependents that he has or the amount of their refund. None of that should be scrutinized or used as criteria for setting price models.”

Moon, 64, has been in business since the late 70’s, working formerly as an auditor for the city of Baltimore and now for himself. He earned his Associate’s Degree at Baltimore City Community College, and a Bachelor’s Degree in business management from the University of Baltimore. His company’s name is an acronym for the services he provides: accounting, taxation, payroll, auditing, and consulting. Moon says that he uses a form-based price model that has nothing to do with either of those things.

“I’ve heard horror stories…people tend to succumb to just being anxious to get some money back to get out of Christmas debt or maybe to keep the lights or gas and electric on during the winter,” he says. “You should scrutinize who is doing your taxes, the level of knowledge that they are working with, where did they gain their knowledge.”

Moon says there are free, reputable tax services available. He also suggests going to http://dat.maryland.go to search for legitimate businesses. He’s also not averse to do-it-yourself tax software – although with a caveat.

“The software does a lot of the work for you and I never discourage people from using it or going into an Office Depot or Staples and buying a little $50 TurboTax or Kiplinger’s TaxCut, but it helps if you’ve had the experience education and knowledge of taxation itself,” he says. That way, you’re not putting yourself in the position of being under undue scrutiny from the International Revenue Service.

Moon says when he prepared his first income tax for someone else – for his mom, in 1976 – computer software and fancy gadgets weren’t available. He completed it with just a pencil and paper. However, he embraces the changes that come with time.

“I have younger children and I think children force you to adapt to technology. It was made easier for me several years ago with the affordability of the home computers and I’m always looking forward, not backwards.”

Another word of advice from Moon: don’t be in such a rush to complete your taxes. It sounds counterintuitive but Moon says that in the rush to file, sometimes people make big mistakes and have to make amendments to their paperwork – and that means extra questions and some raised eyebrows from the IRS.

“Amendments can be complicated and a lot of times the data has to be very credible and the source documents available for review,” he says. “Now my business clients, homeowners, they are the middle to the late tax filers because they are realizing that it’s important to have everything needed when you file it originally. You can save yourself a lot of time, a lot of headache.”

He also says that people should be prepared for their taxes to look a little different next year, in the aftermath of Congress’ recent changes to U.S. tax law.

“[The changes are] affecting people this year currently,” he says. “They just won’t see the effects of it until they file their 2018 tax returns. There are things like increased standard deductions for persons who don’t itemize deductions. For people who do itemize deductions, there’s going to be a cap on…personal property mortgage interests. There are things that are going to change but those changes won’t be recognized until we file the 2018 tax returns.”

[ad_2]

Source link