We bring news that matters to your inbox, to help you stay informed and entertained.

Terms of Use and Privacy Policy Agreement

WELCOME TO THE FAMILY! Please check your email for confirmation from us.

If approved by voters, Ohio would become the 24th state to legalize recreational marijuana for adult use; lawmakers retain authority to tweak or even repeal policy

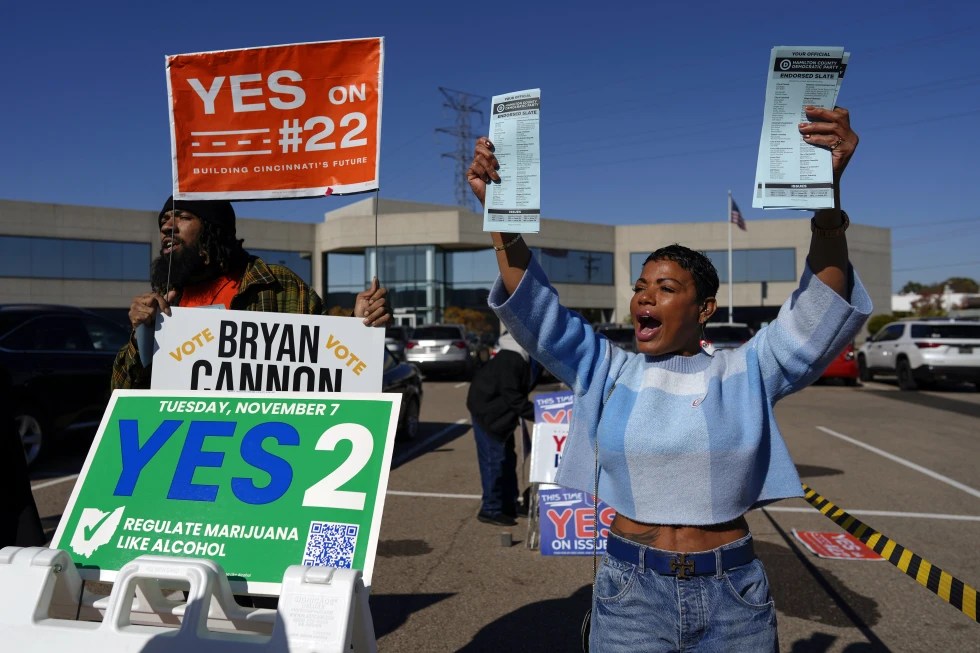

COLUMBUS, Ohio (AP) — Voters in Ohio will decide next week whether to legalize recreational marijuana, but people on both sides of the issue say more hangs in the balance than simply decriminalizing the drug.

Supporters of legalization say Ohio can reclaim tax revenue being lost to states such as Michigan, where marijuana is legal, and take power from illegal drug markets through government regulation. But opponents warn of increased workforce and traffic accidents by people under the influence, and argue much of the revenue will land in the pocket of the marijuana industry, not taxpayers.

Issue 2 on the Nov. 7 ballot would allow adults 21 and over to buy and possess up to 2.5 ounces (71 grams) of cannabis and 15 grams (about a half-ounce) of extract, and to grow up to six plants per individual through a government program. A 10% tax would be imposed on any purchases, with those proceeds going toward administrative costs and addiction treatment in the state and to municipalities that host dispensaries.

It would also create a social equity program to give a financial boost to people who want to start a business selling or growing cannabis and who meet certain criteria. They or a family member would need to have had a past run-in with the law for marijuana, and be part of a disadvantaged group based on race, gender, disability or economic considerations.

The program would fall under the Division of Cannabis Control in the state Department of Commerce, an office that will fashion the rules around licensing, testing and product standards, among other regulations.

If it passes, Ohio would become the 24th state to legalize recreational marijuana for adult use, a move that supporters say socially and financially makes sense for the state.

“We’re taking money away from drug dealers and Michigan dispensary owners and putting it back into the pockets of our local governments,” said Tom Haren, spokesperson for the pro-legalization campaign Regulate Marijuana Like Alcohol.

The measure also gives those with marijuana-related arrests and convictions, as well as their loved ones, a chance to benefit from the industry once possession of cannabis is no longer illegal. Haren said a marijuana charge can make life much harder for people and has a “downstream effect” on their families.

Issue 2, should it pass, would also create greater access for those who may not be able to afford medical marijuana through their insurance or get a doctor to sign off on it. This includes veterans, according to Haren, who usually get their insurance through the federal government — which has not cleared marijuana for medical or recreational use.

But even if it gets the needed votes Tuesday, the future of marijuana use will not be entirely set.

As a citizen-initiated statute, the measure went first to the Republican-dominated Legislature. Lawmakers had four months to pass it, under state law. But with many — if not all — GOP legislators heartily against it, the measure did not move.

After the election, if it passes, state law calls for the measure to return again to the Legislature, where lawmakers can tweak it to their liking. They can also vote to repeal it entirely, as GOP Senate President Matt Huffman has indicated could happen.

Opponents of Issue 2, including Ohio prosecutors and the Ohio Chamber of Commerce, are in line with Huffman.

“There’s legalization, which generally people have a live-and-let-live attitude about. And then there’s Issue 2,” said Scott Milburn, spokesperson for Protect Ohio Workers and Families, the main campaign against the issue.

The measure, opponents say, gives around one third of the revenue in that 10% tax revenue back to the marijuana industry — making it more of a benefit to marijuana corporations and small businesses than to taxpayers.

And according to Ohio Treasurer Robert Sprague, the portion allotted for costs such as addiction treatment and administration under the 10% tax isn’t enough, and the tax would at least need to be doubled to pay for what the measure says it would.

The Ohio Prosecuting Attorneys Association has also cautioned that legalization could lead to greater traffic and workforce accidents, as well as increased substance abuse among state residents.

Last year, a study by the by the National Highway Traffic Safety Administratio n found that 54% of injured or killed drivers had drugs or alcohol in their systems, with tetrahydrocannabinol (THC), an active ingredient in marijuana, the most prevalent.

The study looked at over 7,000 cases from seven different hospitals around the country from 2019 to 2021, but the authors of the study cautioned that it’s not indicative of drivers nationwide, especially when tracking data on marijuana use and traffic accidents is still so new.

TheGrio is FREE on your TV via Apple TV, Amazon Fire, Roku and Android TV. Also, please download theGrio mobile apps today!