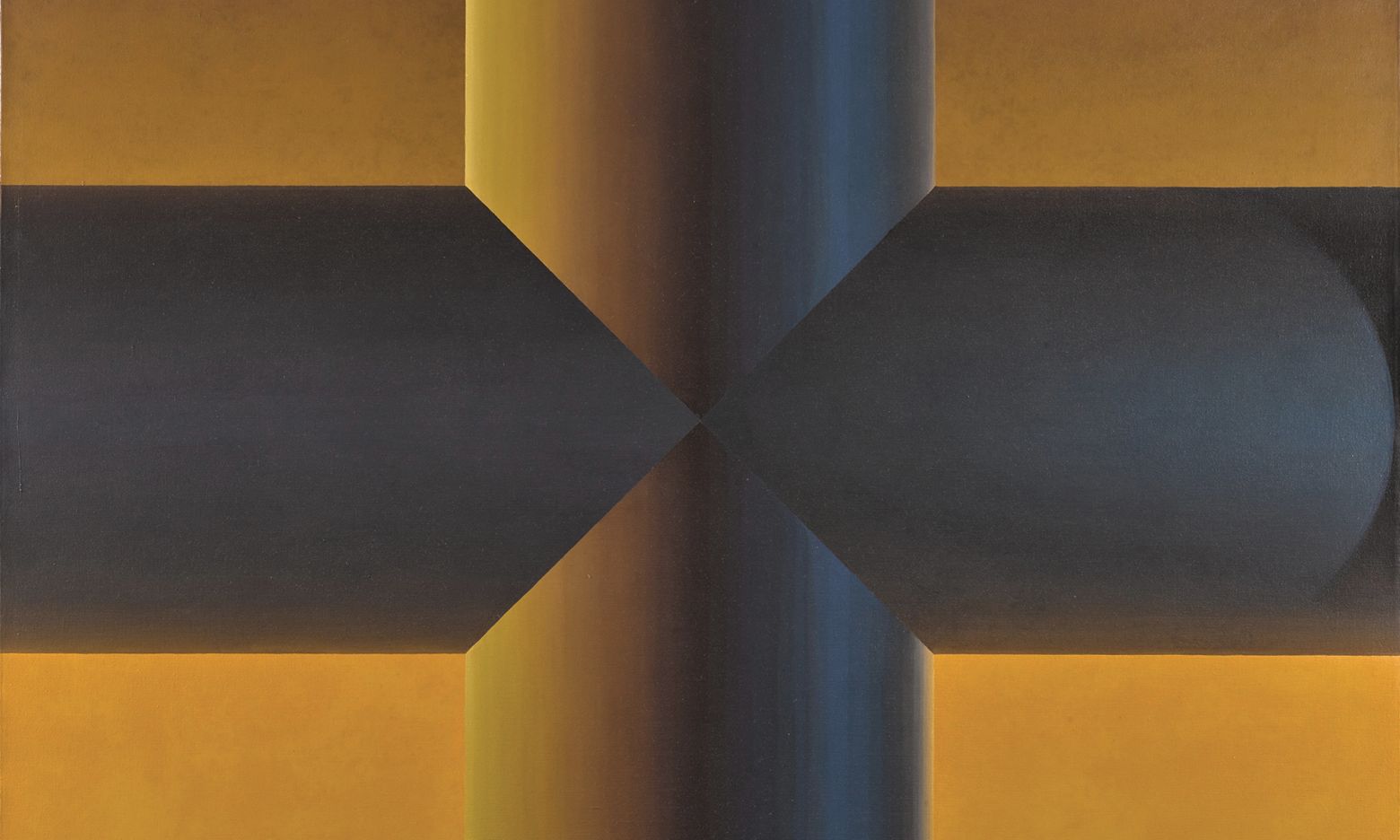

Samia Halaby’s Seventh Cross No. 229 (1969) sold for £300,000 (£381,000 with fees), triple its low estimate, at Sotheby’s 20th century art of the Middle East sale in London on 24 October

Halaby: courtesy Sotheby’s

The Middle Eastern and North Africa (MENA) art world breathed a sigh of relief on the evening of 9 November, after Christie’s two auctions of Middle Eastern Modern and contemporary work in London defied fears that the genre’s recent momentum might be halted by tensions over the Israel-Hamas war.

The market had seemed unsettled on 24 October, when only 54% of the lots offered in Sotheby’s 20th century art of the Middle East sale in London found buyers. Despite the geopolitical strife, however, a closer look at the results in all three auctions reinforces that this market sector remains resilient—and that it is also opening itself up to new demographics.

Christie’s main offering was a group of 48 works from the Dalloul collection, founded by the Palestinian-born Lebanese businessman and economist Ramzi Dalloul and his wife, Saeda El Husseini Dalloul, in the 1970s. The collection has since been enlarged to more than 3,000 works—many of them prime examples of Arab Modernism—and transferred to a private foundation in Lebanon by their son, Basel Dalloul.

The Dalloul collection sale made more than £2.4m (£3.1m with fees), topping its presale high estimate of £2.3m. The sell-through rate was a robust 95.8%, with paintings by major Arab artists such as Dia al-Azzawi, Kadhim Hayder and Shafic Abboud all finding buyers.

Christie’s followed the Dalloul auction with a sale of 55 lots from multiple owners that brought £1.65m (£2.1m with fees), also above its high expectation of £1.62m. Bidders set auction records for multiple artists, including Simone Fattal at £38,000 (£47,880 with fees), and Neziha Selim, the sister of the renowned Iraqi Modernist Jewad Selim, for £22,000 (£27,720 with fees).

The deeper worries around the sale stemmed from Christie’s presale withdrawal of two paintings by the Lebanese artist Ayman Baalbaki over complaints about their subject matter: a figure wearing a keffiyeh, the checked scarf associated with the Palestinian cause. Rumours abounded in the lead-up to the auction that Arab collectors would boycott it en masse to protest what could be read as political censorship by the auction house.

Buyers from the conflict zone

But there is little evidence this backlash materialised. Beyond the strong headline results, the two Baalbaki lots that remained in the auctions each sold within or above their estimate ranges after fees. Buyers were active nearly to the borders of the conflict, with at least one bidder phoning in from Jerusalem and a number of Lebanese collectors turning out for the Dalloul works.

Although unfortunate timing may have influenced the poor sell-through rate in Sotheby’s sale on 24 October—barely more than two weeks after Hamas’s 7 October surprise assault on Israel—more mundane factors probably contributed, too. The auction was large, at 123 works, and considered more uneven in quality than Christie’s offerings on 9 November.

Other sales figures also put Sotheby’s auction in a more favourable light than the sell-through rate. Intense competition for the works that did sell—such as Samia Halaby’s 1969 painting Seventh Cross No. 229, which tripled its low estimate at £300,000 (£381,000 with fees)—brought the auction’s hammer total to nearly £3.8m (£4.8m with fees), well within the £3.1m to £4.5m estimate range. In fact, the premium-inclusive total is the highest for a Sotheby’s MENA art sale in London since 2016.

Zooming out, the war in Gaza should have little effect on the MENA market’s main engine, particularly in the contemporary sector: institutional buying in the Arab world. The Guggenheim Abu Dhabi (set to open in 2025) and Mathaf, the contemporary art museum in Doha that opened in 2010, are ramping up acquisitions after years-long lulls. Saudi Arabia’s Ministry of Culture (MOC) is buying at pace from galleries and auctions to fill the numerous institutions in progress throughout the country, especially in Diriyah, the heritage and culture district on the outskirts of the capital. Sources say a number of bids during Christie’s aforementioned auctions were made by Saudi entities, including the MOC.

Some believe the auction houses are increasingly orienting their offerings towards Saudi taste, by offering more works by Saudi artists and reducing the number of pieces featuring nudity. Christie’s multi-owner sale opened with works by two contemporary Saudi artists, Ahmed Mater and Sultan bin Fahad, both of which sold within or above their estimate ranges after fees. Sotheby’s 20th-century Middle Eastern art auction featured a number of Saudi Modernists, led by the pioneering Mohammed al-Saleem, whose untitled 1986 painting made a new auction record of £889,000 (with fees) against an estimate of £100,000 to £150,000.

But Mai Eldib, Sotheby’s senior vice president and head of sales and advisory, Middle East, cautions against reading too much into recent lot lists. Although the house’s 24 October auction featured “a great selection of Saudi works, assembled by a private collector, offered at a good moment for the market”, she notes that Sotheby’s offered artists from Saudi Arabia in its Doha sales “many years ago” and has done so in London since 2017.

Overall, recent sales in the city prove the most violent and divisive conflict in the MENA region in years has not slowed secondary-market auctions of its Modern and contemporary art abroad. Growth is afoot—and with growth always comes change.