[ad_1]

Every year the numbers get worse: soaring rents, booming home prices and dwindling social spending. Since its beginnings as a background issue in coastal enclaves, the housing crisis has gone mainstream, hitting smaller cities and out-of-the-way towns across the country.

This year, HuffPost has chronicled multiple angles of the housing crisis, from its effect on millennials to its impact on inequality to its arrival in unexpected places. Last month, we traveled to six U.S. cities and held a town hall dedicated to housing affordability in Boulder, Colorado, where we asked you to share your housing stories. We also launched Betting The House, a project to hear our readers’ experiences with buying and renting a home in America.

We received more than 400 responses, covering nearly every state and demographic: old and young, urban and rural, renters and owners. They told us how housing affected them and surprised us with the corners of their lives the crisis was creeping into. They broke our hearts and gave us hope. Here’s what they told us.

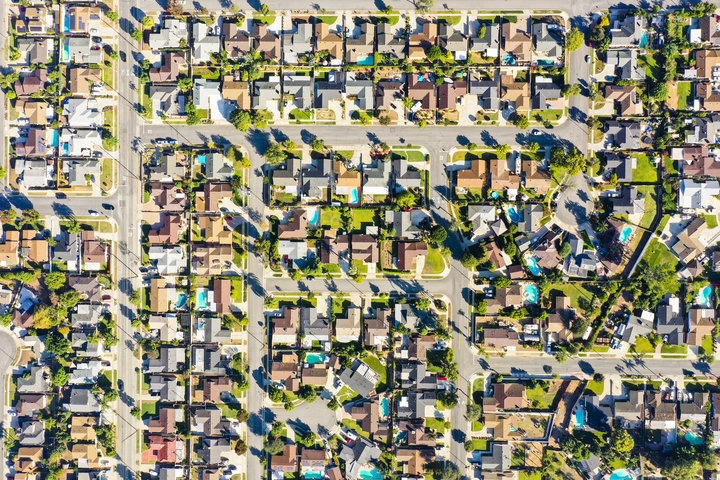

ASSOCIATED PRESS

‘I’ll Have To Choose Between Tuition And Rent’

An overwhelming theme we saw in the responses was that readers are making serious compromises to pay their housing costs. One reader lived with her parents 90 minutes from work and couldn’t afford to move out. Another had delayed marriage for years. A third cooked at home, got rid of her phone, hasn’t had a vacation in five years and sometimes washed her clothes in the sink to avoid laundromat fees.

Overall, 23 percent of our respondents said they spent more than half of their income on housing. More than a third fit the definition of “cost-burdened,” meaning their accommodations took up more than 30 percent of their income. “Housing costs absorb more and more of my take home pay,” wrote one respondent, “so therefore I survive on less. I eat once a day, I do not purchase new clothing or shoes unless absolutely required. My automobile is in need of significant repairs that I cannot afford. And I cannot provide as much support to my children as I would like or that they require.”

Age played a huge role in the responses. Students told us they would never be able to make their housing situation work without their parents. Young workers dreamed of getting out of the paycheck-to-paycheck cycle. One said that if his parents decide to move or kick him out before he graduates, “I’ll have to choose between tuition and rent.”

At the older end of the scale, readers described the difficult transition from working to not working. One reader said that a small pension was never enough to cover Virginia’s housing costs. “Asking for financial help from those I know makes me feel scared and sad but blessed,” this person wrote. “Thank God I now have food stamps which I had never known I was eligible for until this year.”

Many readers described watching their living situations deteriorate ― mold, blocked drainpipes, an oven that didn’t work for a year ― even as their rents kept increasing. “We went from paying $1,200 a month for a two bedroom duplex to $1,675 for the same duplex in a matter of three years,” wrote a reader in San Luis Obispo, California. Frustrated with the rising rent and a landlord who refused to make any fixes, she and her husband moved farther from town. Now, they’ve learned their new landlord is selling their home out from under them.

“My husband is a software engineer and I have a master’s degree,” she wrote. “We have a good income, but we still struggle because of student loans.” They’ve been careful about taking on credit, which means their credit scores aren’t high enough to qualify for a mortgage. “That’s the stupidest thing I’ve ever encountered,” she said.

Getty Commercial

‘I Will Not Raise A Child In Someone Else’s Basement’

One surprisingly common trade-off people said they made was to delay or decide against having children because of the unbearable costs of housing.

“I will never be able to afford a place where a child could live and be educated properly,” wrote a reader in Madison, Wisconsin, whose rent went from one-quarter of the salary for a public service lawyer 10 years ago to more than half today. “I work double the hours for less pay. I changed jobs for opportunities I thought would lead to merit-based pay raises and promotions. Turns out I was wrong.”

A reader in New Jersey said she was renting a basement apartment with her husband since his parents moved away and couldn’t house them anymore. “My husband and I will not have children in our current housing situation,” she wrote. “I understand you’ll never have enough money for kids, but I will not raise a child in someone else’s basement. I will not bring a child into our family when we live paycheck to paycheck and barely have enough to meet our basic needs, let alone the medical emergencies we run into. Sometimes being a good parent is knowing not to have them.”

Many respondents said they couldn’t afford a home in the neighborhood where they grew up. “We can only have one child because we cannot afford a three-bedroom home in our city,” wrote one person in Denver. “If we wanted to have two children we would need to move 80 miles from our work.” Another New Jersey resident said that he and his family have “no affordable options” to remain in their current city — the only place he’s ever lived — and that “the demands from my wife that we move away to an area more affordable [have] caused some very tense moments in our marriage.”

But the most heartbreaking was the reader who said she has been homeless since January. “My children live full time with their dad who is financially stable with an income of well over $100,000 a year,” she wrote. “They unfortunately are not allowed to see me because I don’t have a place to bring them to.” Though she works in Bloomington, Minnesota, she drives 20 minutes away to sleep in her car every night, because the police will arrest her if she stays within city limits.

The Washington Post via Getty Images

‘It’s CONSTANT Anxiety’

Economists have documented the growing insecurity of the American economy for years, and our readers have been living through it. In nearly every response, someone mentioned fearing homelessness, eviction, a job loss or a medical bill. Homeowners said their greatest fear was an unexpected home repair and increasing property taxes. Renters worried about losing their subsidized housing. Rural residents feared the costs of car maintenance. One reader said her greatest worry was that she would not be able to remain in her home after her husband died.

Many readers had already scaled down their lives and were worried that one more hit to their finances would be the final straw. “I was forced to live in an unlivable apartment because my house got foreclosed [on] and this is all my dad and I can afford,” said one respondent. Another, a teacher in New Jersey, wondered if her salary will increase at the same rate as the health care costs and pension contributions that are draining out of it. “As a single woman renting and also house-hunting, I’m shocked at what’s out there in my price range,” she wrote. “I’m basically looking at all foreclosures, and many of them need repairs that aren’t worth the upfront cost of the house.”

The greatest anxieties came from renters. “Our apartment is owned by a large corporation,” one wrote, “and I fear our rents will continue to rise even as the apartment complex falls apart. It’s CONSTANT anxiety. I worry every time they even plant a new bush that it will eventually be factored into our rent increase next year.”

Bloomberg via Getty Images

‘Is This The American Dream?’

The final theme that came out in the responses was anger and frustration at the political decisions that have created the housing crisis.

“It’s completely unaffordable! I go to school full-time and work two jobs and it would be impossible to live on my own. Is this the American dream?” wrote one respondent, a student at the University of San Diego. Others noted the barriers to building houses in big cities, the lack of subsidies for affordable housing and the tiny percentage of cities that offer rent control.

We also heard a lot about how the housing crisis intersects with other social issues like inequality, racial discrimination and climate change. “My neighbors in Oak Park won’t be able to continue to live here,” worried one Sacramento, California, resident. “I worry about affordability and displacement of low-income families as Sacramento grows and changes,” wrote another. Others mentioned housing for undocumented students and housing investments being made in already wealthy neighborhoods.

Some of the anger was directed at the right or the left, but most was aimed upward at plutocrats and corporations. “There is no longer a direct relationship between how hard one works and prosperity,” wrote the respondent who said she only eats once per day. “I see people working incredibly hard to put money into the pockets of the very few. […] All other needs are at risk due to the expanding demands of shelter and housing in America.”

Alongside all of these challenges, though, some readers offered a bit of levity. “What is your greatest complaint about your housing situation?” our survey asked.

At least one respondent answered, “Too many stairs :-)”

[ad_2]

Source link