Hot Property: How Three Art Galleries Might ‘Wake Up the Auction Houses in a Big Way’

Talk to art market insiders about great artworks that have made headline-worthy prices, and you’ll soon hear monikers that honor the deceased collectors whose estates are selling them on par with the artists who created them: the Ganz Picasso. The Stralem Picasso. The Pincus Rothko. The Rockefeller Rothko. Such top-notch collections are crucial to the auction market—and if the fate of one major estate is a harbinger of developments to come, the auction houses may have increasing competition for plum consignments.

Some of the splashiest recent successes at Christie’s, Sotheby’s, and Phillips have been bolstered by collections that came to market with the first of the three Ds that generally fuel auctions—death, debt, and divorce. This past February, Sotheby’s secured 10 works, by marquee-name artists like Clyfford Still, Henry Moore, and Richard Diebenkorn, from the estate of Bay Area collectors Harry “Hunk” and Mary Margaret “Moo” Anderson, which brought a healthy $66.3 million on June 29, despite being the house’s first major sale to go all-digital as a result of Covid-19. That same night, the house sold 18 works from Denver cable television magnate Ginny Williams, including pieces by Agnes Martin, Joan Mitchell, and Lee Krasner, that together racked up $65.5 million. Christie’s, in 2019, bagged the meaty collection of publishing magnate S. I. Newhouse Jr., which totaled $216 million and featured Jeff Koons’s stainless-steel Rabbit that sold for $91 million—the highest price ever achieved at auction for a work by a living artist. Two years ago, Christie’s secured the estate of a lifetime: that of banker David Rockefeller and his wife, Peggy. It brought $833 million for 2,000 items, led by works by Picasso, Matisse, Monet, and Seurat.

S.I. Newhouse’s Jeff Koons, Rabbit, 1986, sold for $91 million, a record for a living artist.

Courtesy Christie’s.

While not every collector is a Rockefeller, the market will feel a distinct bump in the next 10 years with the estates of the Baby Boomer generation, currently aged 56 to 76, who number 70 million in the United States. It will all be part of the greatest wealth transfer in modern times, in which Boomers will pass along $68 trillion in wealth (in pre-Covid estimates) to their Millennial children. These collections stand to bolster major market sectors that have long had scant supply, namely Old Masters, Impressionists, and Moderns.

Many of these estates will be diverse, and rich in contemporary art, says Laura Paulson, now head of Gagosian Art Advisory after nearly three decades at Christie’s, during which the house sold estates including those of fabled art dealer Virginia Dwan and Victor and Sally Ganz (of Ganz Picasso fame). “As the market has expanded, this generation, which is international, has taken collecting very seriously. The opportunities for collecting are global as a new generation of art and artists and collecting venues ha[s] emerged,” Paulson told ARTnews.

Part of that diversification will come from collectors focused on Black artists. The long-overdue remediation of generations of neglect has commenced in earnest in the primary market and begun its rise in the secondary; over the last decade and a half, in addition to the meteoric rise of Jean-Michel Basquiat, artists Mark Bradford, Glenn Ligon, and Julie Mehretu have seen their auction volume and prices climb. Between 2018 and 2016, according to the Artnet Price Database, Bradford’s auction volume rose from near zero to above $20 million, while Ligon’s volume rose from near zero to nearly $10 million; Mehretu’s rose from near zero to a high of about $11 million in 2013. At the same time, a generation of collectors like Pamela J. Joyner and her husband, Alfred J. Giuffrida—laser-focused on African-American artists—has come into its own.

Ginny William’s Joan Mitchell, Garden Party, 1961–62 sold for $7.9 million in June.

Courtesy Sotheby’s/©Estate of Joan Mitchell

Historically, the very identity of some artworks has been attached to their owners because of the titles they held: popes, monarchs, or the first industrialists. In recent years, auction houses have become skilled at building marketable identities around less famous names than Medici, Elizabeth II, or Frick.

You can trace the most recent inflection point in this development to the arrival on the market of a trio of collections in the late ’90s, says New York dealer Cristin Tierney. The sales—all at Christie’s, as it happens—marked the increasing importance to auctioneers’ balance sheets of major family estates.

The estate of John Langeloth Loeb and his wife, Frances Lehman Loeb, rich in Impressionist and Post-Impressionist paintings, brought $92.7 million in May 1997, then the second-highest total ever for a single-owner sale. Six months later, modern and contemporary masters from costume jewelry heir Victor Ganz and his wife, Sally, racked up a record-breaking $206.5 million. The following year, contemporary works from scientist Jost Herbig and his wife, Barbara, a jewelry designer, brought $11.3 million, then a considerable sum for new art.

The success of these sales provided proof of concept to the houses, which began to maximize their marketing of estates and pitching their services to heirs as a way to immortalize their loved ones, according to Tierney. “They provided a new working blueprint for how auction houses were going to do business in the 20th century,” she said.

Auction houses have always had departments that monitor obituaries, and specialists who butter up trust and estate lawyers. Those attorneys are little-seen but absolutely crucial cogs in the great spinning wheels of estate sales; they may advise collectors on tax ramifications concerning their collections and be charged with implementing their plans, points out Mari-Claudia Jiménez, chairman of Sotheby’s fiduciary client group. Once a collector dies, estate taxes loom, and heirs (or surviving spouses) may find themselves forced to sell a collection to raise the dough; auction house specialists have been known to show up at funerals of those who haven’t picked a seller, business cards in hand.

“A dedicated catalogue and other marketing materials can tell a story of their legacy which they can pass along.’’

And then the race is on. The advisers or executors may arrange a day in which auctioneers woo the survivors. Guiding families through the proposal process and leading those negotiations are “some of the most important things we can do for our clients,” says Dana Prussian, vice president of art services for the Bank of America Private Bank, who, in bringing auction houses to the table, often calls this process a bake-off. Ultimately, if one house outguns the others with a bigger dollar guarantee, it may be game over; likewise, one house may have the closer relationship (say, Christie’s, housed in Rockefeller Center, no less).

David and Peggy Rockefeller’s Claude Monet, Camille assise sur la plage à Trouville, 1870–71, sold for $12.1 million.

Courtesy Christie’s Images

Some collectors have been very deliberate about plotting their own legacy, Jiménez says, going so far as to give interviews and publish a book about their holdings in which they give, for example, stories behind the acquisition of certain pieces and the significance of particular works to them. These become invaluable resources to the house, Jiménez says. When such materials do not exist, however, the suitors’ skill in crafting a promotional narrative may come into play. For decades, auction houses have conducted painstaking research that resulted in promotional catalogues featuring hagiographic biographies and voluminous essays. Those catalogues may go the way of the dinosaur, as auctioneers cut costs and reduce waste, and adapt to a post-Covid, extremely online existence; they’re typically converting to, say, slickly produced digital promos.

Auction houses’ marketing departments will also woo a prospective estate by promising to drum up press interest. The Anderson and Williams collections got plenty of coverage in major outlets before coming on the block, despite not being household names like Rockefeller. It’s a strategy of long standing: In 2001, after Phillips nabbed the estate of real estate executive Nathan Smooke and his wife, Marion, the couple’s Modigliani and Degas got ink in the New York Times. The 72 20th-century artworks fetched $86.1 million on lively bidding by major national collectors—above low estimate, a healthy outcome two months after 9/11.

Marketing has evolved dramatically since then. Christie’s marketed the Rockefeller holdings with the catchy slogan “Live Like a Rockefeller,” which helped bring out not only museum directors and art-dealing titans but also everyday people who ended up bidding so avidly on tea caddies and armchairs that many of them sold for multiples of their three-digit estimates. Christie’s chairman for Americas Marc Porter learned some valuable lessons from the sale, he said: Provenance matters, but the house’s “educational” efforts, which he likened to myth-building, were also vital in reassuring buyers; and, since the proceeds were to go to nonprofits, buyers could see themselves as part of a philanthropic enterprise.

“Client marketing segmentation has become so sophisticated—something I fully absorbed only following the 2016 election—that the ability to deploy multiple campaigns appealing to different regions or categories of clients has become a presumption of our business,” said Porter.

Paulson emphasizes that research and storytelling can be more than just marketing. “I’ve heard often from family heirs that they regretted never having taken time to prepare a comprehensive history of their parents’ collections,” she said. “A dedicated catalogue and other marketing materials can tell a story of their legacy which they can pass along to their children.”

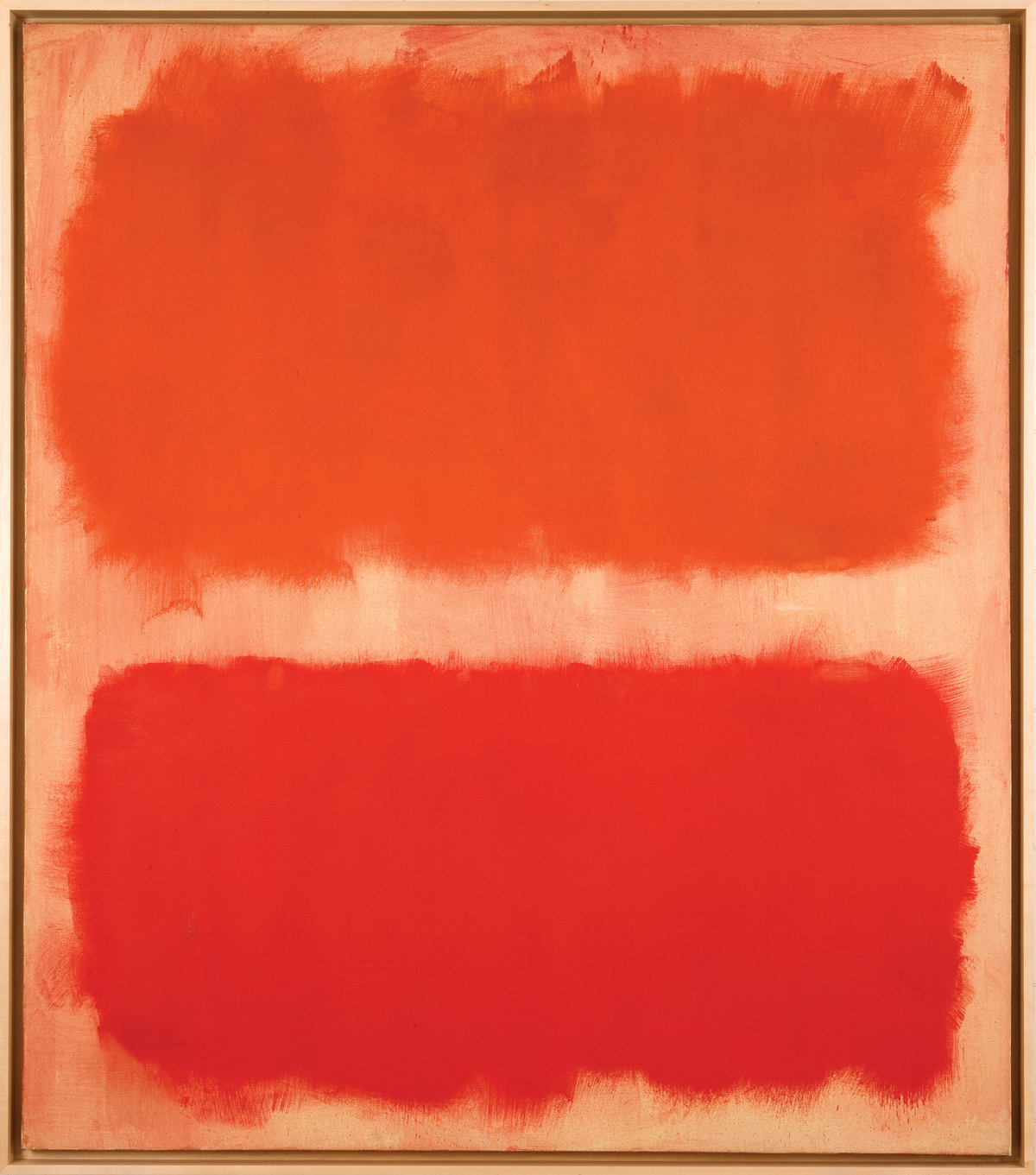

From the collection of Donald B. Marron, Mark Rothko, Number 22 (reds), 1957.

©Kate Rothko Prizel and Christopher Rothko/ARS, New York. Courtesy the Donald B. Marron Family Collection, Acquavella Galleries, Gagosian, and Pace Gallery

Auction houses have always competed doggedly against one another for estates. With the growth of mega-galleries and a recent example of collaboration between them, they may see greater competition from the dealer sector as well. It was big news when, this past February, a mega-dealer trio—Acquavella, Gagosian, and Pace—teamed up to sell the collection of financier and former MoMA board president Donald B. Marron, rich with Picassos, Twomblys, Rothkos, and de Koonings. Totaling some 300 works, the collection was estimated at around $450 million; the Wall Street Journal reported that the Big Three auction houses promised Marron’s widow, Catherine, $300 million, and Eleanor Acquavella confirmed that the trio paid an up-front guarantee. Very quickly, big-ticket works began to disappear into new hands, perhaps not to be seen for years. (In a recent interview with WSJ. Magazine, Arne Glimcher, Pace’s founder, revealed that since the lucrative Marron sale the three dealers call their collaboration “AGP,” and will work together further in attracting estates.)

The arrangement is not unprecedented, Artnet News art business editor Tim Schneider pointed out. The priceless estate of legendary dealer Ileana Sonnabend was split between dealer consortium GPS Partners, Gagosian, and Christie’s, while PaceWildenstein sold the collection of late TV producer Mark Goodson, including works by Picasso, Kandinsky, and Bacon. Notwithstanding two precedents over 25 years, the move is a shot across the bow for auction houses that, since those earlier instances, have only increased their offerings to consignors, for example by beefing up private sales and introducing advisory arms.

If the galleries’ coup portends greater competition, who has the advantage? Well, different sellers will always serve different needs, says Paulson: “Some families understand the added value of the story of the family collection being told and appearing at auction, whereas other heirs prefer to have the estate handled quietly, without public spectacle.”

For one thing, galleries are lighter on their feet than the auction behemoths. Though they may be “megas” within their own sphere, even these three galleries are still comparative mom-and-pop shops. Moreover, it’s in their DNA to do business together: they regularly consign works to each other, and buy artworks from one another at art fairs.

In other circumstances, says Bank of America’s Prussian, selling privately could disadvantage the estate. Auction houses often have deeper specialist teams and more marketing bandwidth. In the case of Marron, as the trio pointed out in announcing the deal, he had a long relationship with all three dealers; collectors without those strong ties may feel an auction house’s capabilities better serve their needs. And, not to be considered lightly, heirs may wish to establish a more public and permanent legacy, says Prussian. When auction houses stage special sales for an estate, she says, it creates an irreplaceable “experiential moment.”

There are other situations, too, where public sales will always win out: For one, when a collector’s heirs aren’t on the best of terms, public sales may be the way to go, New York dealer Andrea Crane points out, because they may want a public record of prices. This way, too, since many people believe that a public sale will bring the highest possible prices, she says, executors can be seen to have done their fiduciary duty.

Still, galleries can exploit weakness. “The Marron model provides a real alternative,” says Harry Smith, executive chairman and managing director of London art advisory firm Gurr Johns. “Auction markets have the fundamental flaw of the risk of non-sale. They have covered that with guarantees, which are fantastically expensive,” he says. (Buyers can promise to acquire an artwork but take a chunk of the profits on items that sell well to others, above their guaranteed offer.) On the other hand, if the houses fail to sell a piece estimated at, say, $100,000, their next move may be to bring it to auction again later—typically tagged at more like $50,000. Galleries can hold on to a piece until the right buyer comes along.

Perhaps weighing in the galleries’ favor, the risk of public failure may increase, Smith says, since the future is so fantastically uncertain, owing to the pandemic and its economic fallout. And, he adds, the Marron triumvirate needn’t be the only one to provide this service. “You might get another grouping, and there might be two or three of these syndicates,” he said. “That would wake up the auction houses in a big way.”

A version of this article appears in the Fall 2020 issue of ARTnews, under the title “Hot Property.”

Published at Thu, 10 Sep 2020 15:50:23 +0000