[ad_1]

By Lisa Snowden McCray, Special to the AFRO

Eddie Brown, Baltimore businessman and philanthropist, says that almost 20 years ago, he began passing down a bit of advice to some family members – two nieces – who had recently given birth.

“They said ‘We want to make sure that we save for their future education,’” Brown remembers, on a phone call from his home.

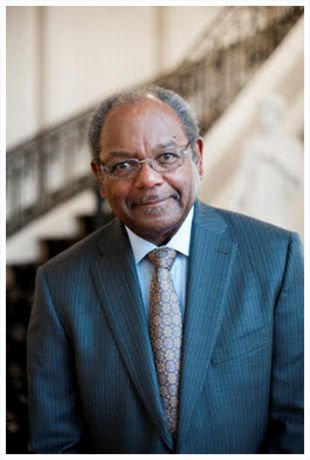

It’s not a bad thing to have someone like Brown just a phone call away. He’s the chairman, CEO, and founder of Brown Capital Management, a prestigious investment firm that has been in business for over 30 years. He and his wife, Sylvia Brown, also own the Mount Vernon-based Ivy Hotel.

“I had an extended session with them and I talked about the power of compound interest and the power of consistency of investing money on regular basis like every month,” Brown remembers.

He says he told his nieces to first figure out whether they wanted to send their children to public or private colleges (private schools, he noted, are much more expensive). Then they looked at the cost of tuition and room and board and factored in inflation. He suggested that they invest in a more aggressive mutual fund.

“In, say, 12 years you can afford to go through upmarkets, downmarkets and you can take the risk of the volatility because you have time on your side,” he said. “They followed the script when each of their children were ready…they had everything prefunded. They didn’t need to take any money out of current income.”

Those babies have long-since grown up and completed their college educations, but Brown says he had another niece with a small baby come to him recently and he gave her the same advice.

“It’s now becoming multi-generational within our family that they are really thinking and investing so the same thing can be applied to anyone, but you have to have the discipline to do it.”

Brown says that a slow and steady, no-drama attitude towards money is how he runs his company, even in the not-so-slow-or-very-steady age of Trump.

“When we are making investments, we are looking at what’s possible with the particular companies that we are investing in over the next three to five years, not over the next month or quarter or even year,” he says.

“And of course we’ve been doing this for a long time and we know that politicians come, politicians go but if we believe in the capitalistic system and we have the ability to identify and invest in great companies run by great managers,” he says. “Over time the U.S. economy will do fine regardless of who is in office and the investment will be rewarded.”

Although the Browns have a lot –a 2016 CNN story listed them among America’s top one percent – they give back a lot, too. They have the Eddie C. and C Sylvia Brown Family Foundation through the Baltimore Community Foundation, which helps funds programs that help black people, specifically in the areas of health, the arts, and K-12 education. They also help support the Reginald F. Lewis Museum, the Walters Art Museum, and the Baltimore Museum of Art, among other Baltimore institutions.

He says that he and his wife have tried to pass along that philanthropic spirit to their children and grandchildren, and even at his firm, where they match charitable donations made by employees.

Brown says that when he and his wife first decided to start donating money, they were given some advice:

“We had a lot of help from professionals in the charitable giving space and they advised us to narrow your areas of charitable giving maybe no more than three and choose areas that you are really passionate about.”

He says that his giving stems from some advice he got many years ago, in church.

“The pastor of the church where we were members at the time made a very prophetic statement that stuck with both of us over the years,” Brown says. “He said those that are blessed should be a blessing to someone especially those less fortunate. So you might say that’s the driving force or motivation behind what we do.”

[ad_2]

Source link