[ad_1]

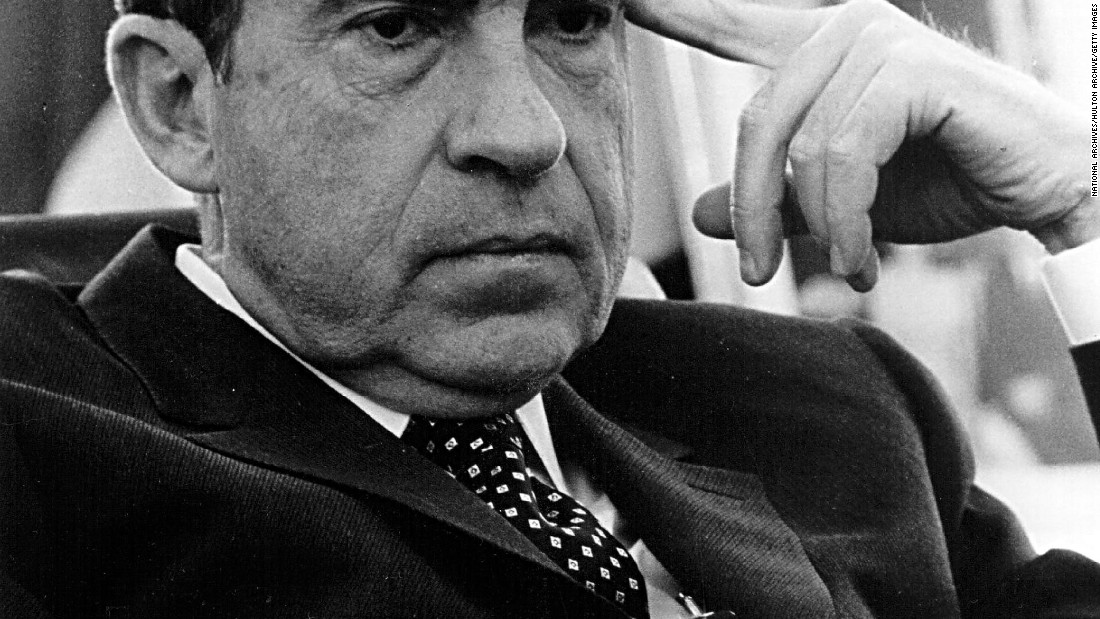

They cite newly surfaced documents that show that when the Joint Committee on Taxation undertook an investigation of former President Richard Nixon’s tax returns that he turned over to Congress, there was tax information that was not covered in that voluntarily disclosure that the committee got directly from the IRS through 6103.

In response to a request from House Ways and Means Chair Richard Neal, Thomas Barthold — the chief of staff of the Joint Committee on Taxation — wrote that he had reviewed materials from the committee’s files on Nixon.

“Based on this review, I can state that the Joint Committee staff sought and received, under its legal authority, confidential information directly from the Internal Revenue Service,” Barthold wrote.

This undercuts the argument from Republican members, the Treasury Department and Trump’s lawyers that the current request for the President’s returns is unprecedented.

President Nixon had voluntarily handed over returns from 1969-1972. But the committee received additional tax information from the IRS from 1966-1968. In a letter dated February 11, 1974, from the IRS, it says it couldn’t provide information for the years prior to 1966 because the “returns had been destroyed, in accordance with our regular procedures.”

At the time, a President could count donate presidential papers as a charitable donation and deduct it from their taxes. Then the law was changed in 1969, but questions emerged about whether Nixon had backdated the date of his donation in order to pay less in taxes and misrepresent that he’d donated them before the law was changed. It is what sparked questions about the need to disclose his tax returns.

[ad_2]

Source link