[ad_1]

It’s almost impossible to comprehend the sheer size of this emergency aid package. It’s similarly impossible to comprehend the economic calamity staring lawmakers in the face if it doesn’t get done. It will get done — that’s the one thing lawmakers and aides from both sides agree on. It’s just a matter of how economically painful it will be before it finally does.

This should be the only question that matters Monday, and as noted above, there is widespread belief a deal will get done, and could be clinched as soon as Monday morning.

“We’re right there,” one person involved in the discussions texted CNN shortly after Treasury Secretary Steve Mnuchin left Capitol Hill just before midnight Sunday night into Monday morning. “But we aren’t there yet.”

Staff from both sides were directed by the principles to work through the night and Mnuchin was back on Capitol Hill at 9 a.m. ET to try and close things out — and that’s the goal, people involved in the talks said, to announce an agreement before or as soon after the market opens as possible.

Schumer met with Mnuchin and Eric Ueland, the White House legislative affairs director, six times on Sunday, the final meeting shortly before midnight.

As Schumer departed, he said this: “We’re getting closer and closer. And I’m very hopeful, is how I’d put it, that we can get a bill in the morning.”

The leverage

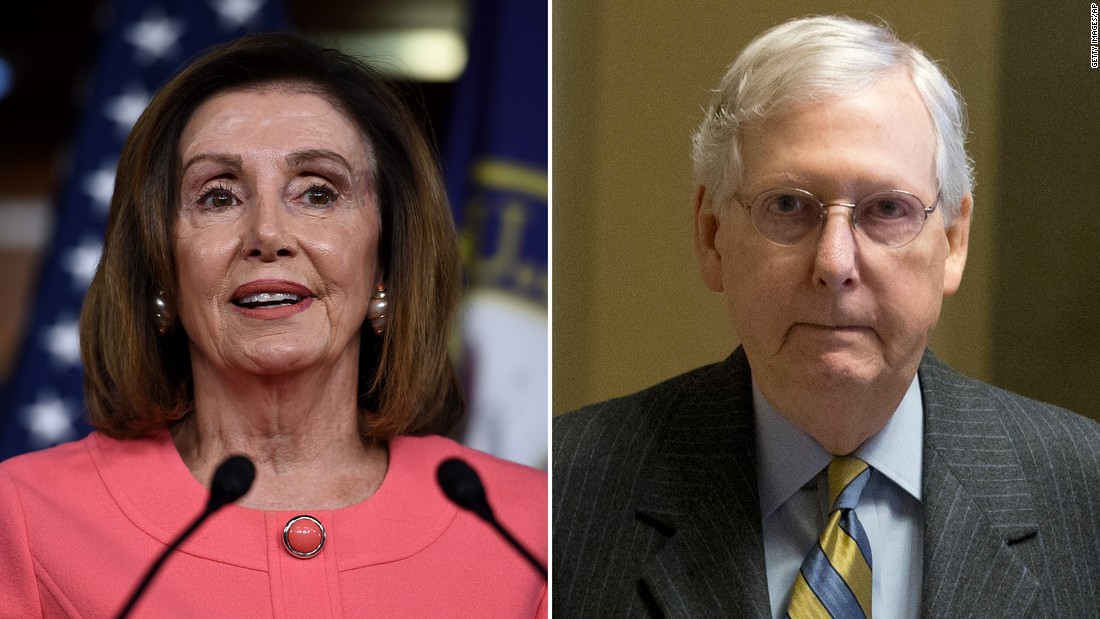

Democrats flexed their muscles on Sunday. Nothing can move through the Senate without Democratic support and nothing will make it to the President’s desk unless House Speaker Nancy Pelosi signs off. If there was a time to make a point, it was Sunday morning, during a meeting of the Big Four, where Democrats made clear their concerns with the standing proposal and showed a united front in opposition to it.

The calculation is essentially this: Democrats wanted significant revisions that had been rejected the night prior. Voting down a procedural motion on a Sunday hurt futures markets and cause some Monday morning market issues, but it can quickly be overcome with a final deal. Sunday was the time to make the play to force changes. The window on this is short, however, and Democrats CNN has spoken to know a deal needs to be reached soon.

To underscore an important point here: this isn’t just about equities markets. The sooner this gets signed into law, the sooner checks go out to Americans. The sooner businesses get their hands on loans. People and companies don’t have days or weeks. That’s just a cold reality. This needs to be done now.

McConnell’s reaction

McConnell rarely moves above the level of monotone English 101 professor when he speaks on the Senate floor. That’s what made his reaction to the Democratic decision to block the procedural vote stand out on Sunday. The Kentucky Republican was furious — red faced, banging the lectern in front of him with his finger to make a point and raising his voice several times.

His point was that the procedural vote was just that — procedural — and negotiations would continue if it was adopted and allowed the process to move forward.

Instead: “The Democratic leader and the speaker of the House decided to blow it all up and play Russian roulette with the markets.”

Pelosi, who returned from California on Saturday night in order to meet in person with McConnell and congressional leaders Sunday, has particularly outraged McConnell, who views her entrance into the talks as single handedly short-circuiting days of extensive bipartisan work.

Democrats counter that McConnell directed his negotiators to move forward with drafting the final proposal Saturday night on their own. That, Democrats said, is what short-circuited the bipartisan process.

This was a long way of saying that Sunday was a day of partisanship and positioning. Monday needs to be a day of the deal.

As one Republican negotiator put it to CNN late Sunday night when asked about a Monday agreement: “I don’t think anybody actually has a choice at this point.”

Underappreciated reality

Democratic senators and staff have repeatedly said this can’t be TARP (the $700 billion bank bailout). The point is this: the policy and political repercussions from that vote are still having ripple effects to this day. The policy fallout is plain — while the emergency efforts saved the financial system and, by extension, the economy, a similar scale of effort and aid wasn’t made available to average Americans, at least not without onerous rules and regulations to overcome and strings attached.

And in the minds of Democrats, they largely got blamed politically for the vote, even though it was drafted and implemented under a Republican administration. That is very, very clear in the minds of senators right now.

“In our desire to overwhelmingly respond, which there is that desire today, there were great mistakes made,” Sen. Bob Menendez, a New Jersey Democrat, said Sunday. “We need to not only have a sense of urgency, we need to get it right.”

The ‘slush’ fund

A prime case in point regarding the above is the almost visceral Democrat reaction to the distressed industries fund in the current proposal.

The proposal includes roughly $500 billion in funds for loans and loan guarantees to be doled out to distressed companies, states and localities. What it doesn’t include, however, are strict guidelines as to which companies would be eligible, guarantees that any company that taps the funding pool maintains its current workforce and the ability for the treasury secretary to waive, at his discretion, any restrictions on stock buybacks for recipients. It also doesn’t require any reporting of which companies took loans until six months after the fact.

The lack of oversight and significant discretion given to the part of the treasury secretary infuriated Democrats and perhaps just as importantly, their outside allies, and played a major role in unifying the caucus against the proposal on Sunday.

The rationale

There are reasons the proposal was drafted as it was. Learning, in part, from 2008, US Treasury officials are wary of dictating too tightly what firms can utilize the loan pool and concerns about the stability of the companies are the reason reporting requirements are waived (should the market learn a company is going to the federal government for help, it would be a sign that things were truly bad and a run would ensue. The flip side of that is that it’s not really a secret who is in trouble right now).

In short: there’s a careful balance to try and strike in emergency actions like this. In 2008, the pendulum swung toward protection of the financial firms and corporations given the scale of the spiral. This time around, Democrats are seeking to ensure the pendulum swings the opposite direction.

All of that said, expect revisions to this section, according to people directly involved in the proposal.

Other significant outstanding issues

Democrats are seeking additional funds for the Supplemental Nutrition Assistance Program (often short-handed as SNAP or food stamps), expanded worker protections and a wider expansion of the length for unemployment insurance. They are also seeking more expansive relief for student loan borrowers.

Perhaps the biggest issue throughout Sunday has remained the structure to deliver funds to states and localities. This is immensely important to Democrats — not just the availability of funds but the mechanism and formula by which those funds are delivered.

The speaker

If anyone needed a reminder of the clout Pelosi wields and power that she has, Sunday was a good reminder. It’s rather obvious: she controls half of the legislative branch and nothing moves without her sign off. She wasn’t ready to sign off and Democrats were unified with her in that position.

Pelosi has made clear House Democrats are drafting their own emergency aid bill. The reality is there is no desire to take that up and try and reconcile two separate packages. “There’s just no time,” one Democratic senator told me. That, more than anything else, explains the hard Sunday stance. This is likely the last chance Democrats will have to shape the proposal. The House will almost certainly take and pass whatever the Senate sends their way.

But Pelosi is still holding out the possibility of House Democrats moving their own proposal until Senate talks turn into something she finds acceptable.

[ad_2]

Source link