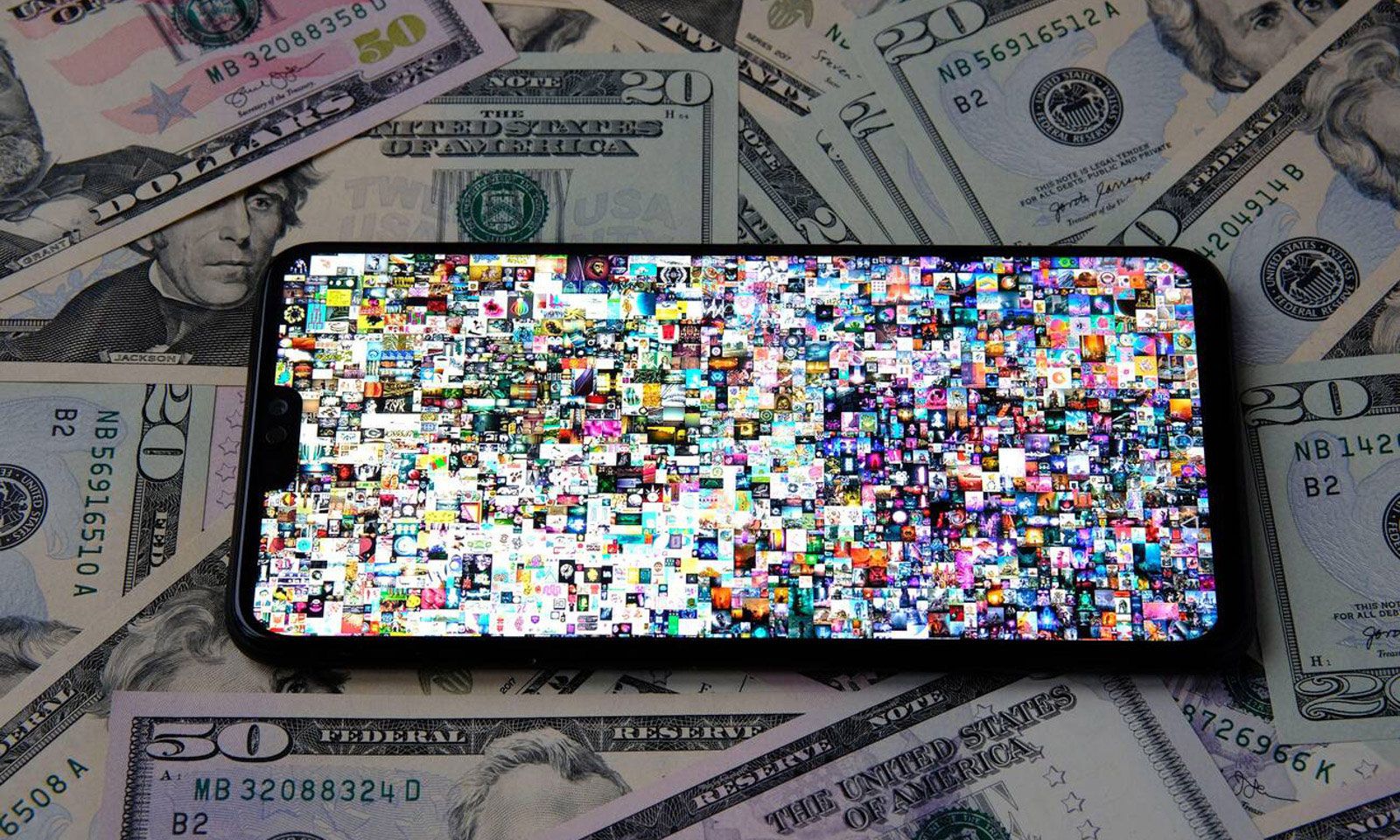

Everydays: The First 5,000 Days by Beeple took NFTs into the mainstream when it sold at Christie’s last March for $69.3m © Ascannio/Alamy Stock Photo

“Do we need more regulation around this? You bet we do.”

So said the US senator (and crypto-critic) Elizabeth Warren in June, as she branded cryptocurrencies “the Wild West” of the financial sector. Warren has been one of many pushing for greater controls of cryptocurrencies and NFTs, and regulators in the US and UK are scrabbling to catch up with this fast-moving field as legal battles mount up. Furthermore, US officials have warned of the thin line between the sale of “fractionalised NFTs” (currently subject to minimal controls) and financial securities (which are closely regulated by governments).

The volatile, “free” nature of NFT marketplaces has already attracted fraudsters. Known scams include “pump and dump” schemes (where misleading recommendations boost the value of stock, before being sold on) and “rug pulls” (where the liquidity in a token is removed by the developer, leaving other investors empty handed). An example of the latter came last October when investors in Evolved Apes NFTs lost $2.7m when “Evil Ape”, the creator of the project, disappeared along with its social media accounts. Insider trading has also reared its head—last year employees of the NFT platforms OpenSea and Art Blocks were found to have been using insider information to invest.

Elizabeth Warren referred to cryptocurrency services as “spinning straw into gold” Photo © Gage Skidmore

“Education is paramount to protect new entrants from falling prey to bad actors, and the online community can contribute to increasing the level of understanding around NFTs,” says Omri Bouton of the London-based media and technology law firm Sheridans. “The industry may also benefit from having standards to allow consumers to quickly identify trustworthy projects,” he adds.

Pre-existing regulations, such as consumer rights and contract law, do occasionally touch on NFTs. For example, where platforms allow fiat payments, the usual “know-your-customer” checks under anti-money-laundering regulations still apply.

Signs that UK and US government bodies are beginning to pay closer attention to the metaverse picked up pace in the autumn, with the focus initially on cryptocurrencies.

In the US, the chairman of the Securities and Exchange Commission, Gary Gensler, announced he was working towards rules to regulate cryptocurrency, and in October the US Department of Justice unveiled a newly-formed National Cryptocurrency Enforcement Team. A later report by the Financial Crimes Enforcement Network (FinCEN) said the Treasury Department would be directing existing anti-money-laundering controls toward virtual currency, while the government’s ongoing work on an Infrastructure Bill suggests that NFTs could soon be subject to greater taxes. But, for an asset held only online, in what jurisdiction should taxes even be paid?

Meanwhile, the Financial Action Task Force (FATF), an international body, has also included specific mention of NFTs for the first time in its updated guidance. And, in the UK, a consultation into the categorisation of “works of art” under new anti-money-laundering regulations provided space for “digital art”, although it offered little suggestion that NFTs would be considered a category within this (the consultation period closed on 14 October, a date for the findings has yet to be published).

The Chinese government’s crackdown on crypto has been less hesitant. After state bans on cryptocurrencies and mining were introduced, state media “warnings” over NFTs are thought to be having an impact on major platforms, including Alibaba’s Ant Group and Tencent, which reportedly changed their use of the term NFTs to “digital collectibles” over the past few weeks.

Much of this government attention is focused on cryptocurrencies rather than NFTs specifically—the former is fungible (exchangeable in terms of their value), whereas the “non-fungible” nature of the latter makes them unique. Still, it demonstrates a broader desire to gain control over virtual trade. “If the authorities decide that NFTs fall under the definition of ‘crypto assets’, then the chances are we will see regulation ramping up over the next few years,” says Chris King, the co-founder of ArtAML. “The art market seems to be waiting for guidance or clarity on how NFTs relate to the current regulations and ways of doing business but, ultimately, it is a new way of working and ownership which needs to be understood on its own terms.”

As governments struggle to move quickly enough to keep up with this fast-moving field, major tech platforms are demonstrating their own innovations geared towards reassuring market participants. The digital news outlet Block Crypto recently reported that Adobe would be introducing a new feature in Photoshop and working in partnership with the major NFT marketplaces OpenSea, KnownOrigin, Rarible and SuperRare on a tool that would “allow people to see attribution for the creator of the NFT, in addition to who minted it”. Start-ups offering to “protect” NFTs are also emerging, including ClubNFT, which offers a bespoke “back-up” system for NFT owners.

“I think we definitely need some sort of regulation, but certainly not from governments or outside entities, rather from within the community in a form of watchdog,” says the NFT collector Amir Soleymani. “Experience shows government intervention won’t work because they have no idea how this space works… if we, as the community, don’t act, any force from outside will destroy the whole ecosystem.”

As governments and the NFT community feel their way towards a balance of freedom and buyer confidence, the legal sector is on its own journey

of understanding.

Law firms are rushing to attract specialist expertise, made more difficult by the international nature of the market and determining the relevant jurisdiction for disputes. The ownership of intellectual property is a central legal dispute, highlighted by the attempted sale of a Basquiat NFT, Free Comb with a Pagoda, advertised on OpenSea in April, with all “related IP and copyrights”, and then cancelled after the late artist’s estate said those rights were not up for grabs. The level of “originality” involved in the minting or creation of an NFT, rather than the creativity involved in the original work of art upon which it is based, is also being considered.

There are rumblings, too, that gambling regulation could be applied to NFTs, according to Jon Sharples of the London-based firm Canvas Art Law, who adds: “Regulation and legislation will always lag behind innovation in this area. In the same way that Uber changed the way people expect to get cabs long before regulators could catch up, NFTs will change people’s expectations around what ‘ownership’ of digital assets means before legislators can agree on what to do about it.”