[ad_1]

In addition to recently partnering up with Bumble to assist in their venture fund targeting female-founded venture-backable companies, tennis star Serena Williams has publicly launched her own fund, Serena Ventures, focusing on investing in diverse founders.

“In 2014, I launched Serena Ventures with the mission of giving opportunities to founders across an array of industries. Serena Ventures invests in companies that embrace diverse leadership, individual empowerment, creativity, and opportunity,” Williams stated on her site. Even though she has been quietly investing in dozens of companies over the last five years, it has not been officially publicized as a fund until now.

Serena Ventures focuses on early-stage companies helping to mentor young founders and take companies to the next level. Through her fund, founders get access to relationships and she encourages collaboration among portfolio companies to expand partnership opportunities.

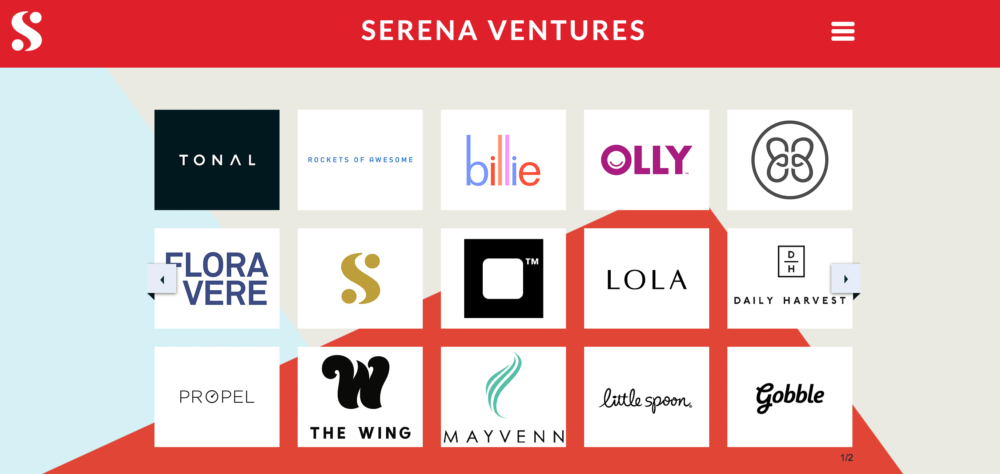

Williams has currently invested in 30+ companies including, female only co-working space The Wing and black-owned hair company, Mayvenn. “We are proud to be a part of Serena Ventures portfolio,” stated Mayvenn on a recent Instagram post. “As a Black-owned, Oakland, California based company we’ve had humble beginnings; we are committed to uplifting our community as we rise. Serena Williams is a change maker with a passion for diversity and empowerment and we are grateful for her support! Thank you, Serena.”

Portfolio Companies (Image: Serena Ventures)

Serena hired Alison J. Rapaport, CFA, as the vice president of the fund to oversee portfolio management and sourcing new investments. Rapaport’s background consists of working at J.P. Morgan in asset management, specifically Multi-Asset Solutions and she led the development of the firm’s Alternative Beta offering.

Her education includes graduating magna cum laude from the University of Pennsylvania, Wharton School, with a Bachelor of Science in Economics with concentrations in Finance and Operations & Information Management and a minor in Psychology. Additionally, she is a CFA charter holder and earned her M.B.A. from Harvard Business School.

The firm will continue to invest in companies that include businesses that touch e-commerce, food & beverage, fashion, health & wellness, social good, with an emphasis on minority and female founders. Currently, their portfolio consists of 60% of diverse founder investments.

[ad_2]

Source link