[ad_1]

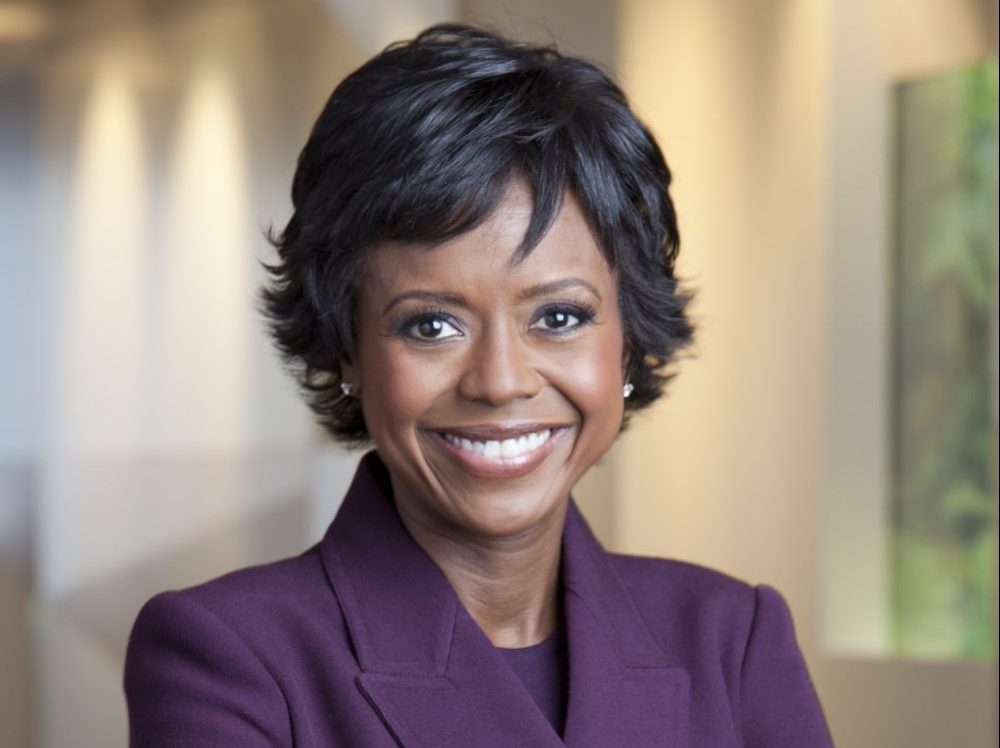

Mellody Hobson’s trailblazing accomplishments over the past few months have given women all over the world a new level of confidence. She was recently elected to the board of directors of JPMorgan Chase and will advance to the role of vice chair at Starbucks at the end of the month.

It’s no surprise that Morningstar, a leading independent investment research firm headquartered in Chicago, selected Hobson to deliver the luncheon keynote at the 2018 Morningstar Investment Conference on Tuesday, June 12. The conference brings together thousands of the most innovative minds in the investment world and Hobson’s nationally recognized work on financial literacy and investor education makes her a highly sought-after speaker.

During Hobson’s presentation, she discussed the markets, Ariel Investment’s story, the value of diversity, and her recent board appointments.

“We haven’t done the exotic things that everyone else does,” says Hobson, president of Ariel Investments—one of the largest diversity-focused investment firms in the world with over $10 billion assets under management (No. 1 on the BE 100s Asset Managers list, Black Enterprise‘s list of the nation’s largest black-owned businesses). “Just because we are good at one thing, doesn’t mean we would be good at another.” Hobson emphasizes how Ariel is a focused firm with concentrated portfolios. She also shares how patient investing and value investing have been two themes that have driven the direction of Ariel.

Ariel is known to be strategic in their investment approach but the firm has also evolved as a model company when it comes to attracting and retaining the best and most diverse leaders in the industry. According to a Chicago Tribune report from September 2017, Ariel’s staff is composed of 51% women and 27% African-Americans. Unlike many other finance-focused firms, two-thirds of the leadership team is female.

“We think that diversity is a competitive advantage for Ariel. And it’s shocking to us that other people don’t see it,” says the TED Talk speaker who transformed the diversity conversation in 2014 with her speech titled, “Color Blind or Color Brave? “We actually joke that if we are likeminded in our point of view about a stock, it’s going to be a problem. We really want to challenge each other and make sure we are looking at every conceivable angle and idea. The only way you can do that is by having people come with different points of view. All that leads to a perspective that can shape an outcome.”

Not only is working with a diverse team of individuals important, it’s also crucial to surround yourself with the best leaders in the industry. Hobson’s recent board position gave her access to the greatest leaders in finance.

“I get to sit next to a dynamic, iconic leader like Jamie Dimon several times a year and learn from him,” Hobson says. “Warren Buffett talks about the fact that he was a better investor because he was on boards. It has been a gift for our firm to sit in the rooms we get to sit in and see what we have seen.” Hobson is also a director of The Estée Lauder Cos. Inc., chair of The Economic Club of Chicago’s board of directors, and chairman of After School Matters.

In 2000, Hobson became president of Ariel Investments at the age of 31. She started her career as an intern at Ariel Investments in 1991 after graduating from Princeton University. She rose up the ranks at Ariel and gained hands-on experience that has helped her to accelerate her progress.

“I didn’t go to business school. Ariel was my business school. I learned in real time. Why would I go learn about case studies when I have real-life case studies that I’m dealing with… like leading a mutual fund company?”

[ad_2]

Source link