[ad_1]

In the wake of a Democratic request to the IRS to obtain copies of six years of President Trump’s personal and business tax returns, Republicans are charging that Democrats are taking presidential harassment to a new level in a move that amounts to sour grapes after Attorney General William Barr reached anticlimactic conclusions from the Mueller report.

Throughout the day Thursday, the president’s supporters rallied to the defense of the president.

“The Democrat agenda is still strictly focused on harassing the president and trying to make political statements, as opposed to trying to solve real problems,” House Minority Whip Steve Scalise, R-La., told reporters Thursday.

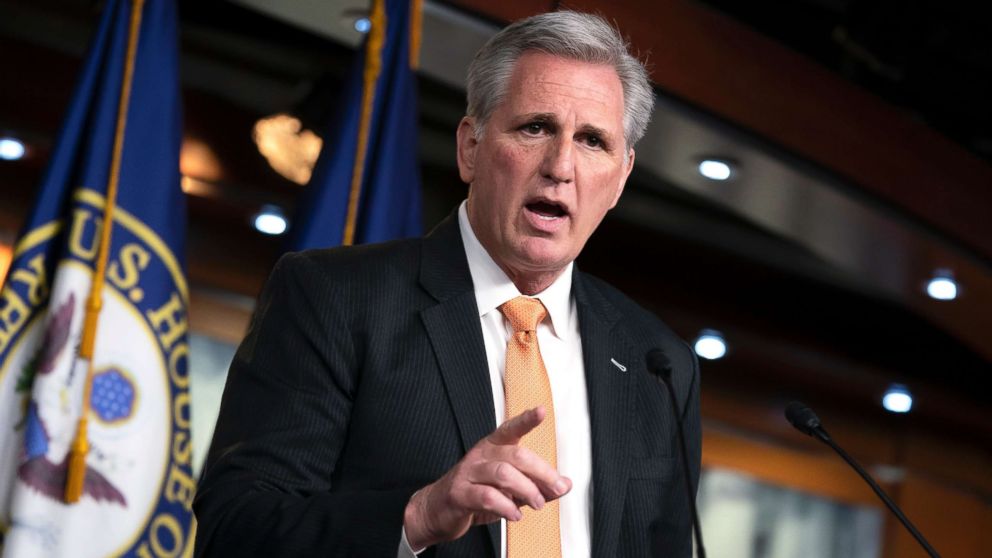

House Minority Leader Kevin McCarthy said the request is “not only is it a waste of time, it sets a dangerous standard of having the federal government used as a political weapon.”

“The Democrats decided the day after the election that they would not accept [the results],” McCarthy, R-Calif., said. “So what do now? They use the power of government, the fear that every American has the government has become so strong they go after you because they don’t politically agree with you. It’s wrong.”

Across the aisle, House Speaker Nancy Pelosi contended that “the law is very clear” that the president’s returns are subject to congressional review, reading the text of the law from U.S. code to reporters at her news conference.

(J. Scott Applewhite/AP) House Minority Leader Kevin McCarthy meets with reporters on Capitol Hill in Washington Feb. 28, 2019.

(J. Scott Applewhite/AP) House Minority Leader Kevin McCarthy meets with reporters on Capitol Hill in Washington Feb. 28, 2019.“This is a policy matter,” Pelosi, D-Calif., said. “The president and vice president are audited. That’s what happens. Congress has an oversight responsibility to see that that is happening if it has happened and how it has happened – and that’s the policy aspect of this.”

One other lawmaker empowered to request Trump’s tax returns, Senate Finance Chairman Chuck Grassley, asserted that Democrats are seeking Trump’s tax returns, not to reform any tax-related law, but to take down the president.

“When you strip out all their pretexts, and when you strip out their circular logic, all you have are Democrats who want to go after the President any way they can,” Grassley, R-Iowa, said. “They dislike him with a passion, and they want his tax returns to destroy him. That’s all this is about, and it’s Nixonian to the core.”

The top Republican on the House Ways and Means Committee forcefully pushed back on Democrats’ request, warning the move weaponizes the tax code.

“No party in any Congress should have the authority to rummage around in your tax returns purely for political reasons, and if they can do that to the president what stops them from doing that to any political enemy?” Kevin Brady, R-Texas, said. “We have four committees in Congress seemingly trying to dig up dirt somewhere on this president, instead of doing the work the American people really want done.”

Sen. Ron Wyden, D-Oregon, the top Democrat on the Senate Finance Committee, called on Treasury Secretary Steve Mnuchin to have no involvement in responding to Neal’s request, arguing it would amount to “blatant political interference” of the request sent to the IRS commissioner.

The statute Democrats are relying on, however, specifies that “the Secretary…shall furnish” returns to the relevant congressional committees.

Asked whether the IRS commissioner should comply with the law and allow Ways and Means chairman Richard Neal to review the president’s tax returns, Scalise said “ultimately that’s going to be something the IRS commissioner is going to have to decide.”

“I think a lot of Americans are shocked to know that the chairman of the Ways and Means Committee and his staff can go and just dig around and start reviewing tax returns for American citizens, whether it’s a blue collar worker, the President United States or anybody.”

Considering Trump is not bound by law to release his tax returns himself, Scalise stressed that Trump has complied with current law through financial disclosures.

“He’s made it clear, you know through the years that he’s going to fully comply with the law, which he has, Scalise said. “If somebody wanted to add a requirement to have tax returns be part of that, let them go through the legislative process.”

Rep. Dan Kildee, a Democratic member of the Ways and Means committee, stressed he expects the IRS commissioner to follow the law and fulfil the chairman’s request.

“This [six-year] period gives us a good window into the president’s activities and the IRS enforcement during the period before he became a candidate, the two years that he was a candidate, and then the last two years where he’s been President of the United States,” Kildee, D-Mich., told ABC News. “The point of all of this is to examine to the extent to which the IRS is auditing and enforcing federal tax law on the President of the United States.”

While Democrats expect the president to mount a legal fight to block the request, Kildee said the committee “is obviously quite curious about the extent to which the IRS is properly performing their responsibilities.”

“We expect that the IRS commissioner will follow the law. Section 6103 of the code is very clear: the chairman of the Ways and Means committee can request a copy of these returns and the IRS commissioner is legally bound to provide them. So we first of all expect the IRS commissioner will not ignore the law, but we expect that the president may push back,” Kildee said. “Look, we’re going to do our jobs, whether he’s willing to do his or not. And we’re going to use every legal avenue available to use to make sure that we uphold our constitutional oaths.”

Neal has set a deadline for the IRS commissioner to respond by April 10, which Kildee said shouldn’t be a heavy lift because “these are returns that have long since been filed.” If the IRS does not comply, Neal could escalate the showdown with a subpoena.

“The IRS absolutely has access to these returns,” Kildee said. “One of the benefits of asking for six years of returns is that we know that the IRS is in possession of six years of tax returns for any taxpayer in the country. So it should not be an enormous lift. I think the question is whether they’ll follow the law.”

Kildee said it’s premature to speculate whether the documents could shed any additional light on the president’s potential financial entanglement with nefarious interests, but said there’s “great public value that comes from the transparency of having the president’s tax returns available.”

Kildee said that there “a corollary benefit” knowing the financial interests of the president so the public can “determine for themselves whether or not his financial interests impacts his public policymaking.”

House Democrats haven’t stopped at Trump’s business filings. On Wednesday, the House Ways and Means Committee formally requested six years of Trump’s personal and business tax returns, amid a monthslong pressure campaign from progressives.

ABC News’ Ben Siegel contributed to this report

[ad_2]

Source link